Keep up to date on Emerald’s

news, insights and events.

Event, Feb 12, 2026

In this presentation, David Volpe, CEO of Emerald, is joined by Stacey Sears, Senior Vice President, and Joe Garner, Director of Research, to reflect on 2025 market performance and explore opportunities ahead.

more

Event, Feb 12, 2026

Emerald’s Groundhog Day 2026 brings our annual tradition into a more focused, virtual experience—sharing timely insights on where markets are headed and how Emerald continues to evolve.

more

Event, Feb 12, 2026

Watch as Joe Garner (Director of Research and Portfolio Manager) talks with Dr Terry Smith and Dr Nishit Trivedi on the Life Sciences sector and outlooks for 2026.

more

, Feb 05, 2026

Team Emerald begins 2026 by welcoming the equities-focused strategies and teams from affiliated adviser F/m Investments.

more

, Nov 17, 2025

We’re proud to share that Emerald Advisers has been named one of Pennsylvania’s Best Places to Work for 2025 by Best Companies Group in partnership with the Central Penn Business Journal.

more

Insights, Oct 06, 2025

Introducing Small Talk – Where the ideas are big, but the market caps are small. Episode 3 – Technology

more

Insights, Aug 04, 2025

Watch below as David Volpe (Deputy CIO), joined Schwab Network’s segment, “Trading 360” to discuss a META earnings preview panel.

more

Insights, Jun 16, 2025

Introducing Small Talk – Where the ideas are big, but the market caps are small. Episode 2 – Industrials

more

Insights, Jun 11, 2025

David Volpe, CFA (Deputy CIO) appeared on The Watch List with Diane King Hall on Schwab Network on June 6.

more

Insights, Apr 17, 2025

Introducing Small Talk – Where the ideas are big, but the market caps are small. Episode 1 – Banking Trends and Insights

more

Insights, Mar 25, 2025

David Volpe, CFA (Deputy CIO and Portfolio Manager) recently appeared on BNN Bloomberg’s “Hot Picks” and chatted with Jon Erlichmann – sharing his insights on three companies he believes are poised for strong growth in sales and earnings. The three key investment opportunities?

more

Insights, Mar 19, 2025

While our team predicted an early springtime for small caps, the reality has been more turbulent—echoing Punxsutawney Phil’s call for six more weeks of winter.

more

Insights, Mar 05, 2025

Watch Emerald’s Dr. Nishit Trivedi as he explores AI’s transformative impact on life sciences and medicine with podcaster and YouTube creator, “Another Jacob Rants”

more

Insights, Mar 04, 2025

The financial sector continues to evolve. While banks faced challenges in 2024, those headwinds are now behind them.

more

Insights, Feb 18, 2025

Emerald’s Stacey Sears recently joined CNBC’s “Squawk Box” to share insights on the latest small-cap earnings trends.

more

Insights, Feb 18, 2025

2025 Tech Outlook: Key Predictions from Emerald’s Experts

more

Insights, Feb 12, 2025

Following our 32nd Annual Groundhog Day Forum, we’re excited to share key insights from our latest whitepaper

more

Insights, Feb 06, 2025

Is the long-awaited shift in market leadership finally happening?

more

Insights, Dec 09, 2024

David Volpe, CFA and deputy CIO of Emerald Asset Management, talks about NVIDIA’s Q3 earnings and how they exceeded expectations.

more

Insights, Dec 04, 2024

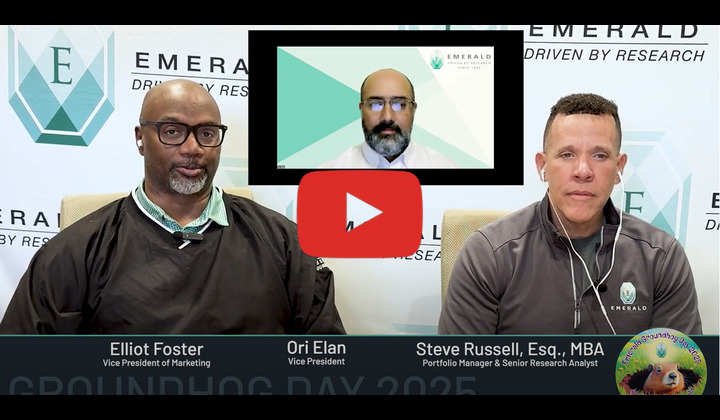

Watch as: Damian Gallagher (AVP – Client Relations & Business Development) and Joe Garner, MBA (Director of Research and Portfolio Manager discuss Emerald’s Small Cap Growth strategy through 3Q24.

more

Insights, Nov 27, 2024

Watch as Nishit Trivedi, PhD, MBBS, MBA(Director of Life Sciences Research), Terry Smith, PhD, MBA (Director of Life Sciences Research) and Joe W. Garner, MBA (Director of Research & Portfolio Manager) explore life sciences opportunities in this interview:

more

Insights, Nov 04, 2024

Stacey Sears, Emerald Asset Management portfolio manager joins CNBC’s ‘The Exchange’ to discuss the case for small caps, how resilient the economy is, and more.

more

Insights, Oct 31, 2024

Penned by our experienced Life Sciences team, this white paper provides an overview of some of the unique investment opportunities in the life sciences industry driven by innovative breakthrough science worldwide.

more

Insights, Oct 31, 2024

Emerald Advisers, in partnership with F/m Investments, announces the launch of the F/m Emerald Life Sciences Innovation ETF (LFSC)

more

Insights, Oct 29, 2024

David Volpe, deputy CIO at Emerald Asset Management, said the U.S. Federal Reserve looks to be on the back foot and a bumper rate cut would help it stay ahead.

more

Insights, Sep 26, 2024

David Volpe, Emerald Advisers Deputy CIO and Joe Garner, Director of Research and Portfolio Manager follow-up after David’s appearance on CNBC London and discuss the first rate cut.

more

Insights, Sep 17, 2024

David Volpe, deputy CIO at Emerald Asset Management, said the U.S. Federal Reserve looks to be on the back foot and a bumper rate cut would help it stay ahead.

more

Insights, Sep 13, 2024

Emerald Advisers is proud to share an inspiring volunteer story about one of our own, Mitch Krahe (Vice President, General Counsel).

more

Insights, Sep 03, 2024

Watch as Damian Gallagher (Client Relations and Business Development) and Joe Garner, MBA (Director of Research and Portfolio Manager) discuss earnings for the second quarter of 2024 in regard to small caps.

more

Mar 06, 2026

Investors … and Fed officials … are probably heading out to the local pharmacies his morning to make sure headache medicine is in full supply as we head into the weekend.

more

Feb 26, 2026

Just when it appeared the economic engine was about to pick up speed … with 10-year Treasuries dropping below 4% and mortgage rates falling under 6% …

more

Feb 25, 2026

Markets are in positive territory this morning, but investors realize this could just be the appetizer …

more

Feb 24, 2026

Stocks are struggling to rebound following yesterday’s decline as the President’s new 10% global tariff has gone into effect.

more

Feb 23, 2026

The President is now looking out the window and the constant changing of his mind has driven the EU to announce enough is enough as they insist….

more

Feb 18, 2026

Markets are up to start the day and while U.S. investors are likely content over how portfolios have performed since the start of this year….

more

Feb 16, 2026

I usually don’t write when stock markets are closed for holidays … such as today … but I figure my teaching schedule and industry work…

more

Feb 13, 2026

Investors have tiptoed back into the markets this morning, allowing a small bit of reprieve following yesterday’s sharp declines.

more

Feb 11, 2026

Early investor excitement was evident in markets shortly following a jobs report that showed much more strength than many anticipated …

more

You are now leaving www.teamemerald.com. Follow the link to learn more about the F/m Emerald Life Sciences Innovation ETF

https://www.emeraldetfs.com/33rd-annual-groundhog-day-exploring-life-sciences-2/ ➜